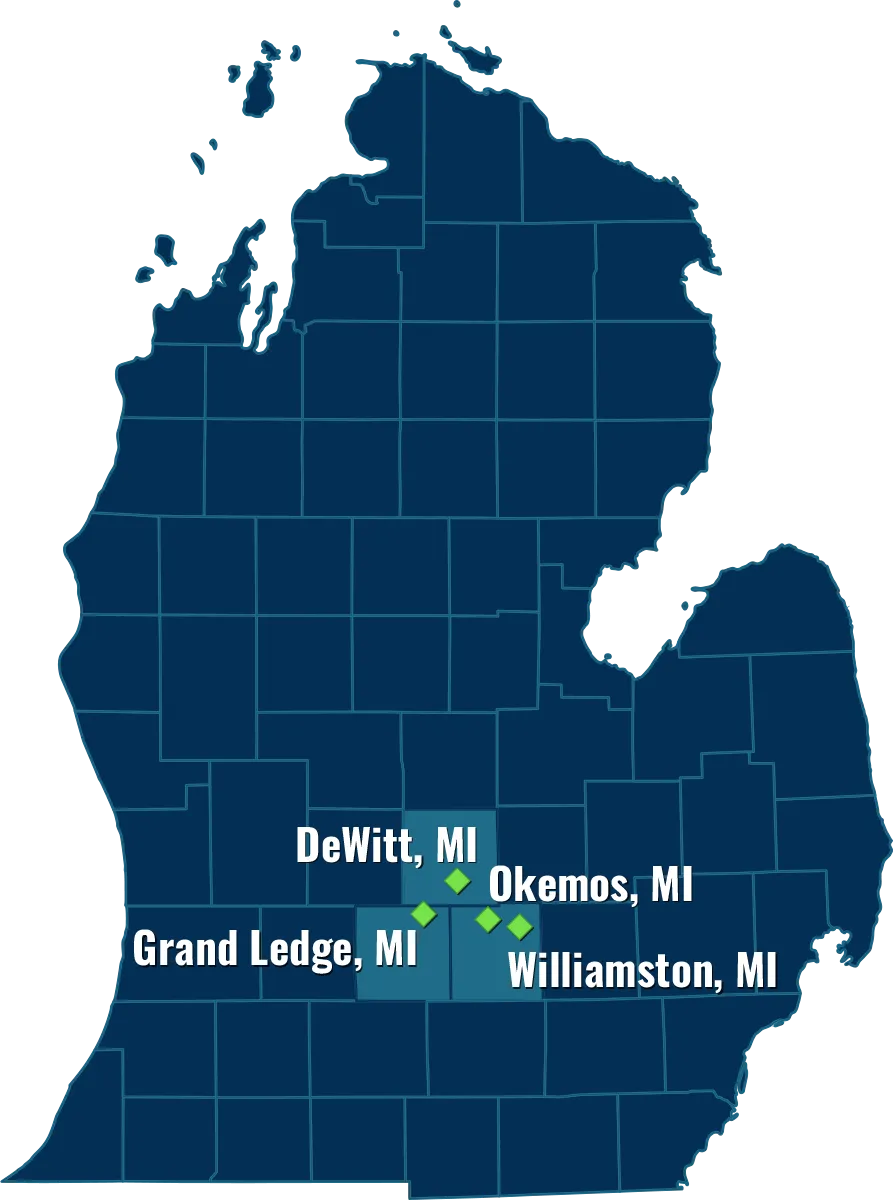

Current client? Reach out to us and get directions:

Current client? Reach out to us and get directions:

Estate planning is a process of arranging for the management and disposal of your estate during your lifetime and after your death. Traditionally, “estate planning” meant having a will. While this can still be a central component of your plan, there are other options in modern estate planning that may be more advantageous and offer greater flexibility.

There are many reasons to do estate planning. One is to make sure that your property passes to the people or charities you want it to go to, and not to the government. Another reason is to minimize the estate taxes, such as the federal estate tax, and expenses that may be incurred by your estate.

Almost everyone needs an estate plan. This is a plan that tells what will happen to your money and property after you die. You need to make one because you never know what will happen in the future. If you have young children, you need an estate plan to make sure they will be taken care of if something happens to you. If you are married, you need an estate plan so that your spouse will be taken care of if something happens to you. If you are not married, you need an estate plan so that your money and property go to the people or charities you want them to go to.

You might think that you do not need an estate plan because you do not have a lot of money or property. This is not true. Everyone has an estate, even if it is small. And, everyone needs to have a plan for what will happen to their estate when they die.

Having a clear and comprehensive plan for your end-of-life wishes is important for many reasons. For the short term, it will give you peace of mind that your affairs are in order. In the future, it can ensure the proper parties receive assets after your death without court intervention or conflict.

A will is a document that dictates how your assets will be distributed after your death.

Trusts are legal arrangements whereby you transfer ownership of your assets to a trustee who manages the assets for the benefit of the beneficiaries you designate.

A power of attorney is a legal document that gives someone else the authority to make decisions on your behalf.

Health care directives are documents that specify your wishes regarding medical treatment in the event that you are unable to communicate those wishes yourself.

Beneficiary designations are documents that name the individuals or entities who are to receive your assets upon your death.

The aim of an estate plan is to establish a framework for distributing assets in the future after you pass away. However, proper planning can include accommodations that help provide stability later in life. Here are the key steps in estate planning:

The first step in effective estate planning is identifying your assets. This typically includes physical property but may also cover:

Locating and identifying all of one’s assets is an important step in crafting a comprehensive estate plan.

The next step involves identifying the beneficiaries of estate plans. These can include heirs in a will or the recipients of property in a trust. Generally, any adult can be named as a beneficiary.

However, there are certain laws that limit the naming of underage beneficiaries or personal representatives. A dedicated trusts and estates attorney at our local firm will assist with the cataloging of assets and the selection of parties who will stand to inherit in an estate plan.

A healthcare power of attorney is someone who you choose to make decisions for you about your medical care if you can't make them yourself. This is important because sometimes people can't make their own decisions about things, like whether they want to be on a life support machine or not. So it's good to have someone who knows what you would want in those situations.

A healthcare power of attorney can be used to make decisions about:

You can name more than one person as your healthcare power of attorney, and you can also name someone to be your alternate healthcare power of attorney in case your first choice can't do it.

You should talk to the person you want to name as your healthcare power of attorney, and make sure they are willing to do it. You should also talk to more than one person, in case your first choice isn't available when you need them.

You might also want to consider naming a healthcare agent in your will. This is someone who would make decisions about your medical care if you became incapacitated and couldn't make those decisions yourself.

Estate Planning Offers a Variety of Options. The concept of what constitutes a proper estate plan has changed over the years. In the past, having a valid will may have been sufficient. According to Michigan Estates and Protected Individuals Code § 700.2501, any person over the age of 18 with sufficient mental capacity can create a will. This document serves as a way to control what happens in probate after one’s death.

As useful as wills can be, they can be inflexible and still subject potential heirs to a lengthy probate process. A possible substitute is to create a trust. Trusts allow for the transfer of property without probate court interference and may go into effect at any time. Additionally, placing property into a trust can have tax benefits for both the trust maker and the recipients of property.

Using trusts in your estate planning can also help you qualify for certain government benefits, such as Medicaid or beneficiaries that have special needs. To fully understand the various functions of a trust, reach out to a Lansing attorney.

If you hire a lawyer, he or she will help you create an estate plan that is tailored to your specific situation and needs. The lawyer can also answer any questions you have and help you navigate the estate planning process.

An estate planning lawyer can also help you:

Working with an experienced estate planning lawyer can give you peace of mind knowing that your affairs are in order and that your loved ones will be taken care of after you die.

Forming an estate plan may seem like a complex undertaking, but it doesn’t have to be with help from an experienced attorney. At the Leydorf Law Firm, PLLC, a Lansing trusts and estates lawyer can walk you through these options and provide creative ways of achieving your desires. From day one, our qualified attorneys can work with you to understand your goals, suggest solutions tailored to your situation, and draft documents that carry out your intentions.

Protecting your assets and providing for the future of your family should always be a top priority. Additionally, the legal team at Leydorf Law Firm, PLLC is well-versed in modern estate planning techniques that can offer substantial financial advantages for the present and the future.

– Okemos, MI Estate Planning

– DeWitt, MI Estate Planning

– Grand Ledge, MI Estate Planning

– Williamston, MI Estate Planning