Current client? Reach out to us and get directions:

Current client? Reach out to us and get directions:

Asset protection is one of the key reasons for estate planning in Michigan. Protecting a lifetime of savings, passing wealth on to the next generation and minimizing estate tax consequences can all be accomplished with a comprehensive estate plan.

There are a variety of asset protection strategies available, and the best approach depends on your specific circumstances. If you're concerned about protecting your assets, it's important to work with an experienced estate planning attorney, like Nick Leydorf, who can help you choose the right asset protection strategies for your situation.

We live in litigious times. People with significant assets are often subject to lawsuits where others feel they have a right to assert a claim. Certain professions lend themselves to litigation and no matter how much malpractice, liability, or errors and omission insurance a person might have, there is always the risk of someone bringing a lawsuit. Asset protection in estate planning is focused on a few different goals:

Estate planning relies on a variety of types of trusts to protect assets. Trusts can be used for the benefit of minor children, grown children, grandchildren, or anyone the grantor wishes. Trusts are also used to share wealth with charitable organizations and minimize tax liabilities. When assets are placed in an irrevocable trust, they are no longer owned by the grantor; they are legal entities with a separate tax identification number. Only put assets in trust if they will not be needed now or in the future.

The Asset Protection Trust (APT) is created solely for the purpose of protecting the grantor’s assets. They can be funded with real property, LLCs, securities, cash, or business shares. They are often referred to as “self-settled” trusts because they are created by the individual for their own benefits. However, these are complex trusts requiring the knowledge and experience of an estate planning attorney to create the trusts properly.

Michigan allows asset protection trusts, but not every state does. Some APTs are subject to liens and judgments, so speak with estate planning attorney Nick Leydorf before embarking on the creation of an APT.

Another tool for asset protection in estate planning is the use of various business entities.

Property can also be protected through the use of a Limited Liability Company (LLC) or Family Limited Partnership (FLP).

Like trusts, LLCs and FLPs are legal entities and separate from the person who creates them. An individual or couple owns only a portion of the partnership but may retain control of the entire partnership and its assets if it is correctly established.

In Michigan, where so many families enjoy summers at lake houses, the Family Limited Partnership is a sensible way to share the home ownership while ensuring the property may be passed down from one generation to the next.

Regardless of the legal entity used, it is important to have asset protection structured long before any problems occur. A court may perceive the creation of a trust or a partnership occurring shortly after litigation begins as having been created solely to thwart creditors and could potentially rule the trust or partnership invalid.

Asset protection, like estate planning, is not a one-and-done thing. It should be updated to reflect any changes in your life, good or bad. Certain trigger events, including death, birth, marriage, or divorce are times when estate and asset protection plans need to be reviewed.

Asset protection can also be structured to take advantage of tax benefits. Assets in a trust are taxed differently than personal income, for instance, and are not included in the valuation of your estate after you have passed. How your asset protection plan is designed should align with both tax and estate planning.

When you are ready to have a conversation about asset protection and how it may fit into your estate planning, contact the Law Office of Nick Leydorf. We will work with you to understand your goals and help you create a plan that meets your needs now and in the future.

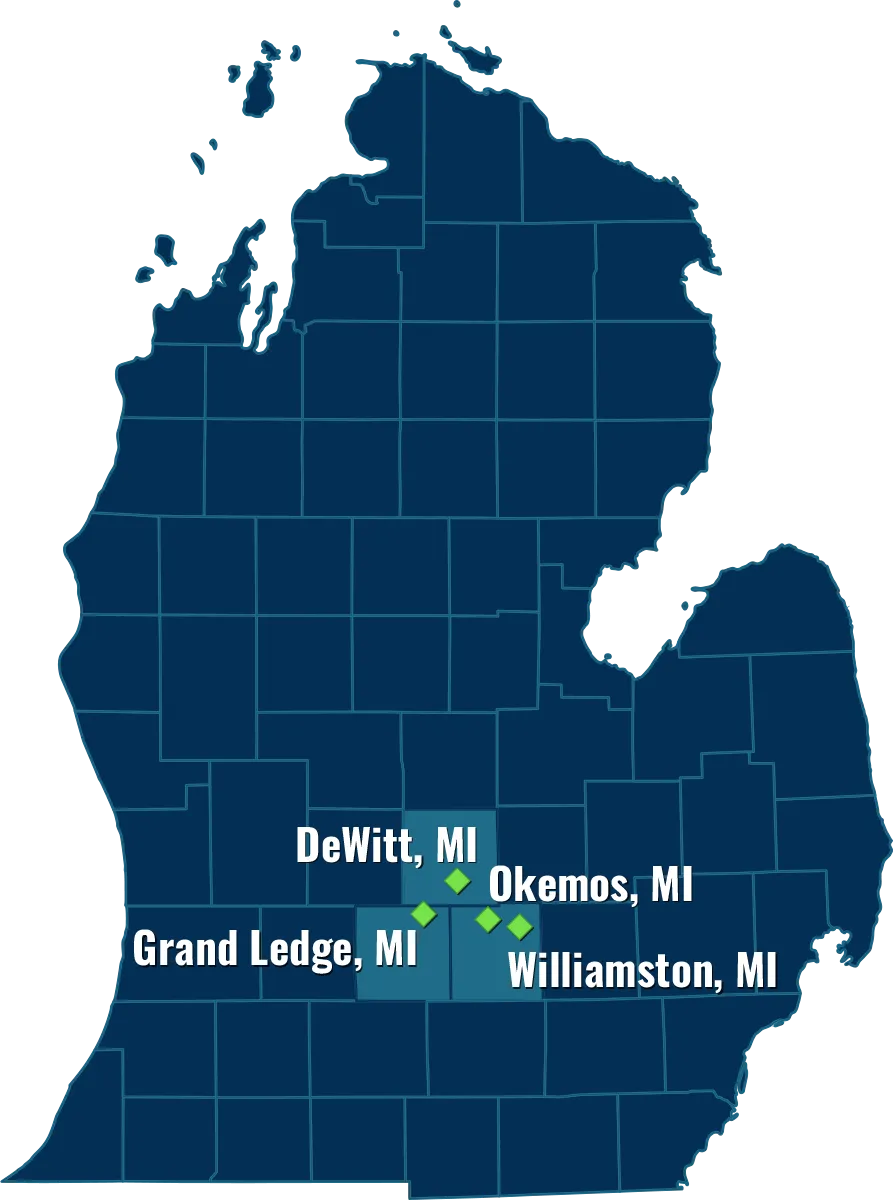

Asset protection attorney Nick Leydorf helps families in Lansing Michigan and the surrounding area. He is a native of Michigan and understands the unique challenges that come with protecting assets in Michigan. He can help you structure your asset protection plan to take advantage of state laws and maximize its benefits.

Call our law firm at (517) 388-6800, or Book a Call today!

– Okemos, MI Estate Planning

– DeWitt, MI Estate Planning

– Grand Ledge, MI Estate Planning

– Williamston, MI Estate Planning