Current client? Reach out to us and get directions:

Current client? Reach out to us and get directions:

No one likes to think about death, but it's something that we all have to face at some point. If you're a Michigan resident, estate planning is something you should definitely consider. This guide will walk you through the 10 most important steps to take when creating your estate plan. By following these tips, you can rest assured that your loved ones will be taken care of after you're gone.

When you think about Estate Planning in Michigan, usually the first thing that comes to mind is a Last Will and Testament. However, Michigan Estate Planning is more than just drafting one document. It requires careful analysis and consideration. The first step is to think about something that may be uncomfortable: What do I want to happen to my assets when I die? This important work will help you and those who can help you navigate through the Estate Planning process.

Having clearly defined goals will assist you in determining which Estate Planning documents will be best for your unique situation. Based on your goals and your particular family dynamics, you may need supplemental documents so that your Estate Plan provides your family with adequate protection.

But what if you’ve never thought about Estate Planning before - where do you start?

Examples of common Estate Planning goals include:

Understanding and referring to your goals throughout the Estate Planning process will help shape your plan and guarantee the outcome is in line with your intentions.

It is important to do SOMETHING! Even if you don’t think you have an estate plan or believe that you don’t have enough assets to create an estate plan, the State of Michigan has a DEFAULT plan for individuals who haven’t taken the time to plan. Typically, people WON’T LIKE the state’s default plan because it involves the process known as probate.

Documenting assets and debt is essential to understanding how much of your residuary, or remaining, estate will be distributed to your beneficiaries. An asset is simply an item of monetary value. Assets include money in bank accounts, properties or real estate, investments, vehicles, and other income-generating resources. A debt, on the other hand, is money owed, such as a credit card balance or some other type of loan. Mortgages, credit cards, and vehicle payments are all forms of debt to be considered.

Recording your assets also is important because it creates a record for those you will leave behind. While balances may fluctuate regularly, your trustees or personal representatives will save a great deal of time if they are aware of all of your assets.

Selecting your Beneficiaries is one of the most important steps when Estate Planning in Michigan. Your Beneficiaries are your loved ones who will receive your assets. Typically, this is a spouse, child, or your grandchildren. In some cases, people name a charity as a Beneficiary. You must put the time and effort into determining who will receive your assets and how much they should receive when doing your Estate Planning in Michigan. This can help prevent your loved ones from fighting over your assets once you are gone. It will also help your Successor Trustee distribute your assets after your death.

Deciding who will execute your plans after you are gone is as important as deciding who your beneficiaries are. Your trustee is what is known as a fiduciary. Whoever you choose should be trustworthy, responsible, and willing to carry out your wishes with attention to detail.

If you choose a Living Trust when Estate Planning in Michigan, this individual is known as your Successor Trustee. If you choose a Last Will and Testament, this person is your Personal Representative.

A Successor Trustee and a Personal Representative have similar roles after you die, but there is a key difference. Because a Will does not avoid the long and expensive Probate Court process, your Personal Representative will be responsible for navigating Probate before they can distribute your assets to your loved ones. This can take months, sometimes even years, especially if your Will gets contested.

On the other hand, a Successor Trustee can distribute your assets to your family in a private setting, often within days or weeks of your passing because a Living Trust, if set up correctly, avoids Probate.

In times of crisis like a serious accident or incapacitation, the last thing a loved one wants to worry about is having access to your finances.

If you become incapacitated, who would pay your mortgage, monthly bills, or loans? Who will file your tax returns? Who would apply for insurance or benefits on your behalf if you aren’t able to do so yourself?

Unfortunately, tragic events often happen out of nowhere. With that in mind, it’s good to plan for these potential scenarios ahead of time when you are formulating your estate plan. Being prepared with a Financial Power of Attorney, also known as a Durable Power of Attorney, can provide your family with a tool that it needs to alleviate some of the burden and prevent your family from having to go to court to get permission to manage your financial affairs.

You will need to name your Agent when creating your Durable Power of Attorney. Your Agent is the person who will have the power to make financial decisions on your behalf while you are alive or if you become incapacitated. This could be the same person as your Successor Trustee or Personal Representative, but it does not have to be.

You may grant your Agent the ability to act in all of your financial affairs or restrict their powers to certain areas. Typically, you can give your agent the power to:

After choosing an Agent, they must confirm they are willing to act on your behalf. Set up regular communication channels with this individual and share your Estate Planning goals with them. The more you interact with your Agent, Successor Trustee, and Personal Representative, the greater understanding they will have of the goals you outlined while creating your estate plan.

If you don’t select an Agent, your family will be forced to petition the Probate Court for a Conservatorship for you. So, it’s best to appoint one in advance properly.

Although it is difficult to imagine, it is important to have a plan for what your loved ones will do with respect to your medical care if you become incapacitated. Accordingly, it is important to reflect on and document any explicit wishes you may have when it comes to your medical care preferences, organ donation, and funeral arrangements.

Some questions to consider:

If you are unable to communicate, you will want to make sure that someone you trust is making your medical decisions for you. You can give someone the legal authority to do so by creating a Medical Power of Attorney or Advance Healthcare Directive naming them as your Patient Advocate. Once you have made these decisions, you should also inform your Successor Trustee, Personal Representative, and Agent, if they differ from the person you selected to act as your Patient Advocate.

If you don’t appoint a Patient Advocate in advance, your family may be forced to petition the Probate Court to become your Guardian to make decisions for you. This is less than ideal in an emergency.

If you have children under 18, you will want to make sure that you nominate someone to raise them if both you and your spouse pass away. If you don’t document this when Estate Planning in Michigan, the state will decide who will raise your children. This situation may be less than ideal, especially if you have family members you wouldn’t trust raising your kids.

Additionally, you should consider putting together a plan to help the guardian cover the cost of raising your children. Once you have determined who you would like to serve as guardian, it’s usually a good idea to speak with them ahead of time to ensure they are willing to handle the responsibility.

The next step in the Michigan Estate Planning process is to gather together all documentation and keep it in one place. This way, when needed, important papers can be readily accessed to begin the administration of your Estate Plan.

Examples of these documents include:

Including these documents alongside your Estate Planning documents will help to prove ownership or relationship changes in the event of a dispute. By setting out clear and legally sound Estate Plans with supplementary documentation, you can help to make the process easier and less stressful for your family and loved ones.

Your Estate Plan is also your opportunity to document your burial wishes. If you would like to be cremated, you can specify what you would like done with your ashes. If you would like to be buried, you can specify where your remains should be interred. Additionally, if you have any special instructions about your funeral arrangements that you would like to communicate to your family, you can document these as well. This is particularly important if you have religious or personal restrictions you would like to be honored.

Once you have made the necessary decisions and advised any relevant parties of your choices, the actual Estate Plan can be developed by drafting the documents required.

There are various documents that you may wish to use depending on your situation:

Will or Living Trust – Both documents distribute your assets to the beneficiaries of your choosing. However, a Living Trust allows you to avoid the long, stressful, and expensive probate court process. This allows you to pass your money, property, and assets to your family in the most efficient way possible while keeping your finances private. It can also help you maintain control of your finances after you pass away and reduce estate taxes. Generally, if you have a house or children, it’s best to use a Living Trust when Estate Planning in Michigan.

Durable Power of Attorney – appoints an Agent to make financial decisions on your behalf while you are alive and if you become ill or incapacitated either temporarily or permanently.

Medical Power of Attorney – appoints a Patient Advocate to make medical decisions on your behalf while you are alive and if you become ill or incapacitated either temporarily or permanently.

Your Estate Planning documents are some of the most important you will create in your lifetime. You worked your entire life to accumulate your wealth, and these documents will be responsible for ensuring that your assets are protected and transferred as efficiently as possible to your future generations.

As a result, you will want to make sure your Estate Planning documents are drafted properly and are legally binding. Will, trust, and estate law changes from state to state, so something that is valid in Ohio may not be valid in Michigan. The best way to make sure your Estate Plan is legally binding is to consult with an experienced Estate Planning Attorney in your state who focuses their practice on will, trust, and estate law.

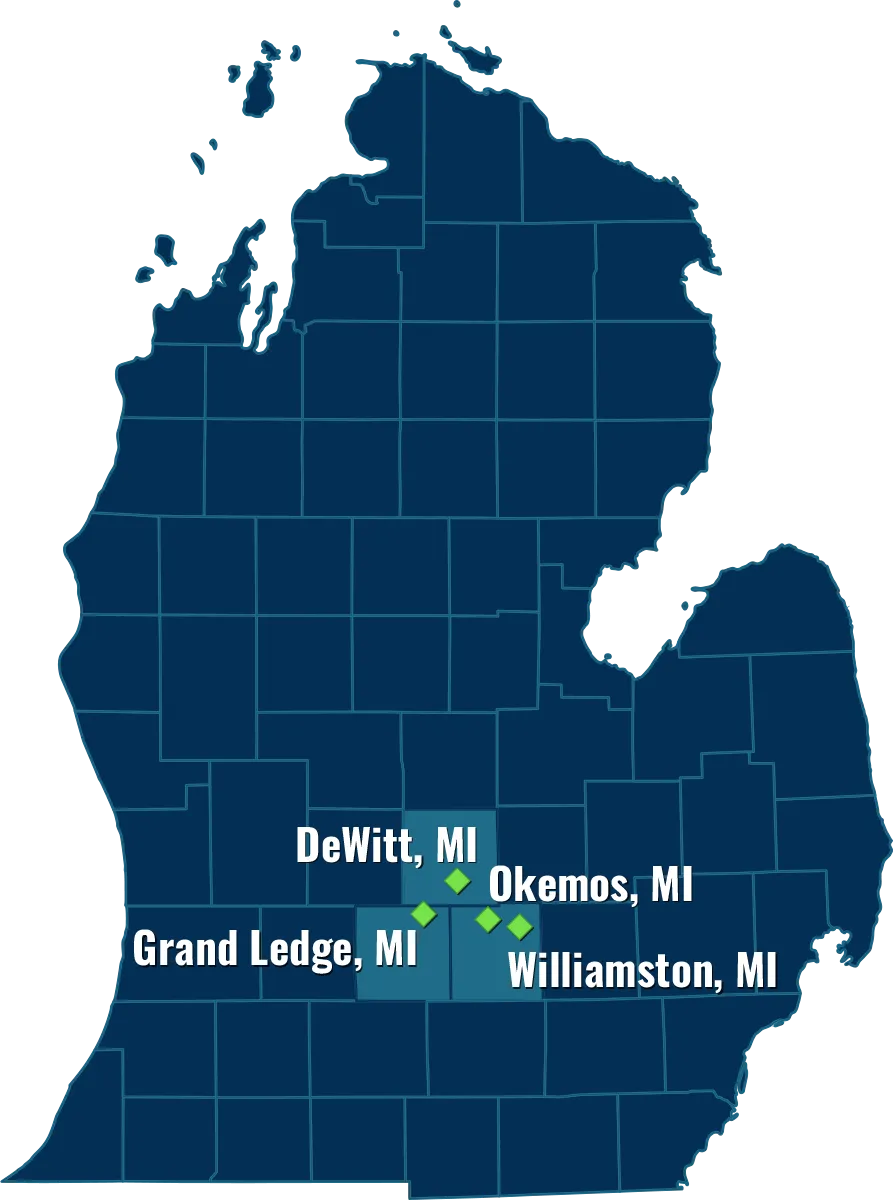

– Okemos, MI Estate Planning

– DeWitt, MI Estate Planning

– Grand Ledge, MI Estate Planning

– Williamston, MI Estate Planning