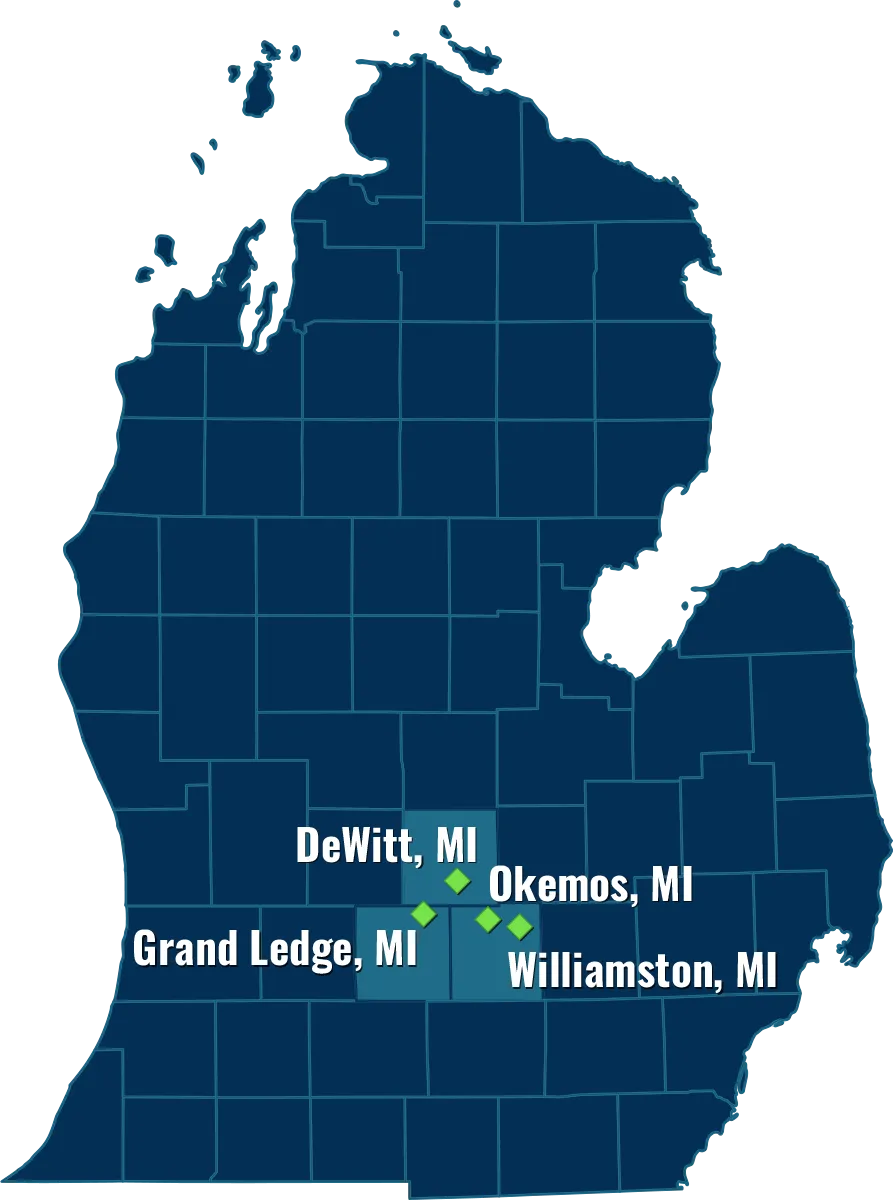

Current client? Reach out to us and get directions:

Your estate plan offers a number of protections for minor children, which is why it’s so important for families in Michigan to have a comprehensive estate plan. While no one likes to think about parents dying young and leaving children alone in the world, these things do happen. Estate planning attorney Nick Leydorf works with families to ensure that children have the protection they deserve.

A minor child in Michigan is a person who is under the age of 18. Until they reach the age of legal majority, minor children cannot inherit assets and must be under the care of an adult. If their parents die, a guardian must be appointed to care for the child until they turn 18.

Each parent needs to have their own will, and each parent needs to name each other as the preferred guardian in case one parent dies. Their wills should also name a back-up guardian in the will, which should be the same person. A secondary back-up guardian should be included as well.

If this sounds overly burdensome, consider what would happen to the children if no guardians were named. The court would make a decision as to guardianship, and there is no guarantee the child’s guardian will be a family member or someone known to the child. Having several back-up guardians ensures your child will be raised by someone you know and trust.

This decision is as difficult as naming an executor, the person who carries out the instructions in your will. Consider the following:

Can My Child’s Guardian Also Manage Their Inheritance?

In many cases, the same person who could be a great guardian might not have the financial skills needed to manage an inheritance, especially if it needs to last for your child’s lifetime. Naming a trustee to be in charge of the trust is an option. The person should be someone you know to be responsible and who will act in the best interest of your child.

In Michigan, minor children may not directly own property, inherit property or make contracts. If parents die without a will, the court will have to decide who should manage the money for the child. Court-supervised inheritance is never simple, nor is it inexpensive.

A trust for a minor is often the best way to provide for a child when the parents have passed.

There are many different types of trusts that can be set up, each with their own unique benefits.

The most important thing to remember when setting up a trust is to make sure that the child's best interests are always kept in mind.

When you set up a trust for minor children, you'll need to name a trustee to manage the money on behalf of your children. The trustee can be anyone you choose, but it's often best to select someone who is financially responsible and has your children's best interests at heart.

You'll also need to specify how you want the money in the trust to be used. For example, you may want the money to be used for your children's education or for their everyday living expenses. You can also decide when you want the money to be distributed, such as when your children reach a certain age or get married.

Creating a trust for minor children can be a complex process, so it's important to seek professional legal advice to ensure that your trust is created correctly.

By naming a trustee and specifying your wishes for the child’s lifestyle, you can rest assured the child will have the education and recreational opportunities you’d want.

Trusts for minor children accomplish several goals:

In short, trusts give parents peace of mind, knowing that their children will be taken care

No one knows what the future holds, but by taking the time to plan for your children's future, you can have peace of mind knowing that they will be taken care of if something happens to you.

When it comes to protecting minor children, estate planning is one of the most important things you can do. By creating a trust for your children, you can ensure that their financial needs will be taken care of if something happens to you. Trusts for minor children can be complex, so it's important to seek professional legal advice to ensure that your trust is created correctly. With the help of a qualified attorney, you can plan for your children's future with confidence.

We invite you to call Nick Leydorf to discuss the estate planning process, and how you can protect your minor children through an estate plan. Book a call with us now.

– Okemos, MI Estate Planning

– DeWitt, MI Estate Planning

– Grand Ledge, MI Estate Planning

– Williamston, MI Estate Planning