Current client? Reach out to us and get directions:

Current client? Reach out to us and get directions:

A business succession plan is an organized plan designed to pass ownership of a business from one owner or partners to another owner, partners, or group of employees. Any privately held business needs a succession plan if it is to make a successful transfer from one generation to the next, or from the original founders to new owners. By establishing a plan in advance of the change, you can increase the chances of the business moving forward and decrease the likelihood of family conflicts.

Business succession planning requires the active participation of a company’s leadership and trusted advisors, including an estate planning attorney to ensure the succession plan aligns with the estate plan. The succession plan needs to be structured so it does not lead to a large, unexpected estate tax event for the original owner or heirs. This is especially important when the original owner’s retirement source is the sale of the business.

The connection between business succession planning and estate planning is that they are both important aspects of estate planning. Business succession planning is the process of planning for the transfer of a business to new ownership, while estate planning is the process of organizing one's assets in order to reduce taxes and ensure that one's wishes are carried out after death. By combining the two, business owners can create a comprehensive plan that will protect their business and their family after they are gone.

Estate planning is especially important for business owners, as the business itself is usually the largest asset. There are a number of ways to align the two, including establishing a Grantor Retained Annuity Trust (GRAT), where the business is transferred to the next generation and an income stream is created. Depending on your situation, a Grantor Retained Unitrust (GRUT) may be a better choice. The trusts must be created properly to minimize or avoid estate taxes.

Some businesses are transferred using Family Limited Partnerships (FLP) or Family Limited Liability Companies (FLLC). If limited partnership units are transferred to successors, they may be taken out of your taxable estate.

These are complex transactions and require the help of an experienced estate attorney who is familiar with Michigan laws.

Privately-held or family-owned businesses need a succession plan to protect the business in case the owner becomes incapacitated or dies unexpectedly. If the owner becomes too sick to run the business, someone else has to be able to step in. if the owner dies unexpectedly and there is no plan in place, the business could suffer major financial losses and incur huge tax burdens.

The succession plan includes an exit strategy for transferring the business, extracting the owner’s capital from the business, and ensuring the business’ continued operation. If a new generation is taking the reins, they will benefit from a formal succession plan.

Minimizing gift and estate taxes is a big part of the business succession plan. Several factors to address include:

Business succession plans contain formal legal documents to provide for distribution of ownership. The agreement can be drafted to become effective with a triggering event, such as the death or incapacity of the owner or retirement. The agreement includes the purchase price and terms.

A well-drafted buy-sell agreement or shareholder agreement can help you avoid many of the pitfalls associated with succession planning. Contact an experienced business attorney to draft a buy-sell agreement or shareholder agreement that meets your specific needs.

You are invited to call Nick Leydorf to discuss how business succession planning works with estate planning, and how doing so will protect your legacy. Call our law firm at: (517) 388-6800 or Book a Call today..

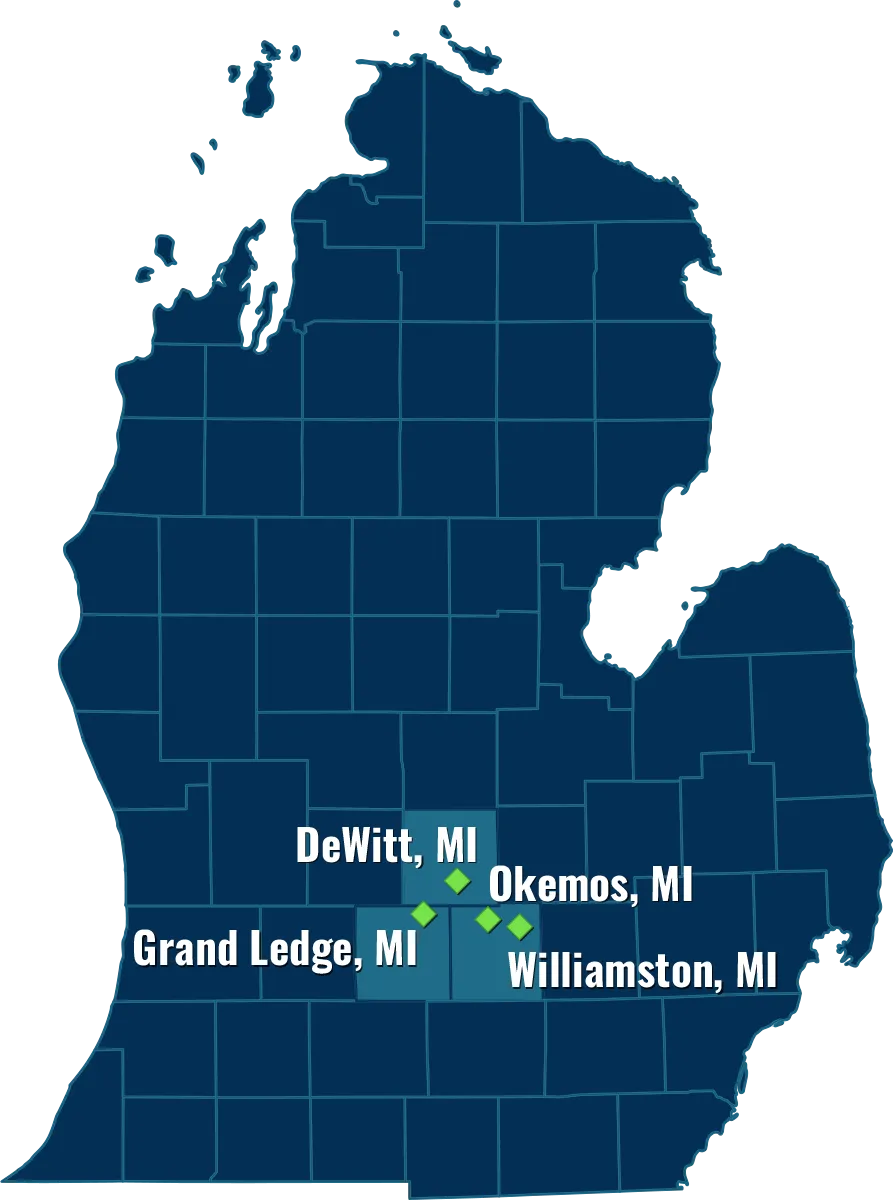

– Okemos, MI Estate Planning

– DeWitt, MI Estate Planning

– Grand Ledge, MI Estate Planning

– Williamston, MI Estate Planning