Current client? Reach out to us and get directions:

Current client? Reach out to us and get directions:

When an individual needs long-term nursing home care but hasn't previously organized their assets to qualify for Medicaid, Medicaid Crisis Planning becomes necessary. Even with prior planning, an experienced Medicaid Crisis Attorney can still safeguard a portion of the family's assets and assist the individual in becoming eligible for Medicaid benefits.

If you find yourself in this situation, please contact our office immediately and inform the receptionist that you require assistance with Medicaid Crisis Planning. We will promptly discuss your situation and explain the available options.

While the Director of Patient Services at the nursing home may sympathize, they may lack the accurate information regarding your loved one's Medicaid eligibility and how to become eligible. Instead of hastily transferring home ownership or depleting lifelong savings, it is advisable to consult Medicaid Crisis Planning Attorney Nick Leydorf to learn about available options and the appropriate course of action. Acting without proper information could jeopardize years of savings.

Many individuals faced with the need for long-term care find themselves in a difficult predicament. If they possess too many financial resources to qualify for Medicaid, they lack sufficient funds to protect their family and spouse from impoverishment. However, a Medicaid Crisis Planning Attorney utilizes legitimate and ethical legal strategies to help individuals become eligible for Medicaid without losing their hard-earned assets.

To qualify for Medicare, an individual must be a U.S. citizen or a legal resident for five years, be aged 65 or older, or have a disability. Medicare eligibility is not influenced by income or assets.

Medicare does not cover long-term care expenses. It primarily assists with specific medical costs, including hospital care, doctor visits, and prescription drugs. Long-term nursing home care and other long-term care costs are not covered by Medicare.

Medicaid eligibility requirements vary from state to state, but all states must provide coverage for certain categories of individuals, including:

In addition to meeting these categories, Medicaid applicants must have low income and limited assets. The income and asset limits differ across states.

Medicaid is a joint federal and state program that offers healthcare to individuals with low income and limited resources. For middle-class Americans, Medicaid becomes a last resort when they require prohibitively expensive long-term nursing home care. Today, only the wealthy can afford to pay the exorbitant costs of skilled nursing care, which can amount to thousands of dollars per month. Paying privately would quickly deplete an average person's retirement savings, making Medicaid planning crucial.

Each state has its own specific requirements, rules, and regulations for Medicaid eligibility. In Michigan, there are various programs available to seniors, and it's essential to determine the appropriate one.

Marital status also affects Medicaid eligibility, with different programs and allowable asset levels for single and married individuals.

Importantly, it's unnecessary to exhaust one's entire life savings to qualify for Medicaid. A skilled Medicaid Planning attorney understands the legally approved strategies to help individuals become eligible for Medicaid while safeguarding their family's assets. These strategies are employed ethically and strategically to protect both the ill spouse and the well spouse.

Improperly completed applications or inadequate structuring of property and assets can result in a Medicaid application denial. If your Medicaid application has been denied, contact our office. We can help with the Medicaid appeal process to ensure you receive the necessary benefits.

Each situation is unique, and the best planning approach depends on your specific circumstances. Do not apply for Medicaid without the guidance of an experienced Medicaid Planning Attorney. Schedule a free consultation with elder law attorney Nick Leydorf today.

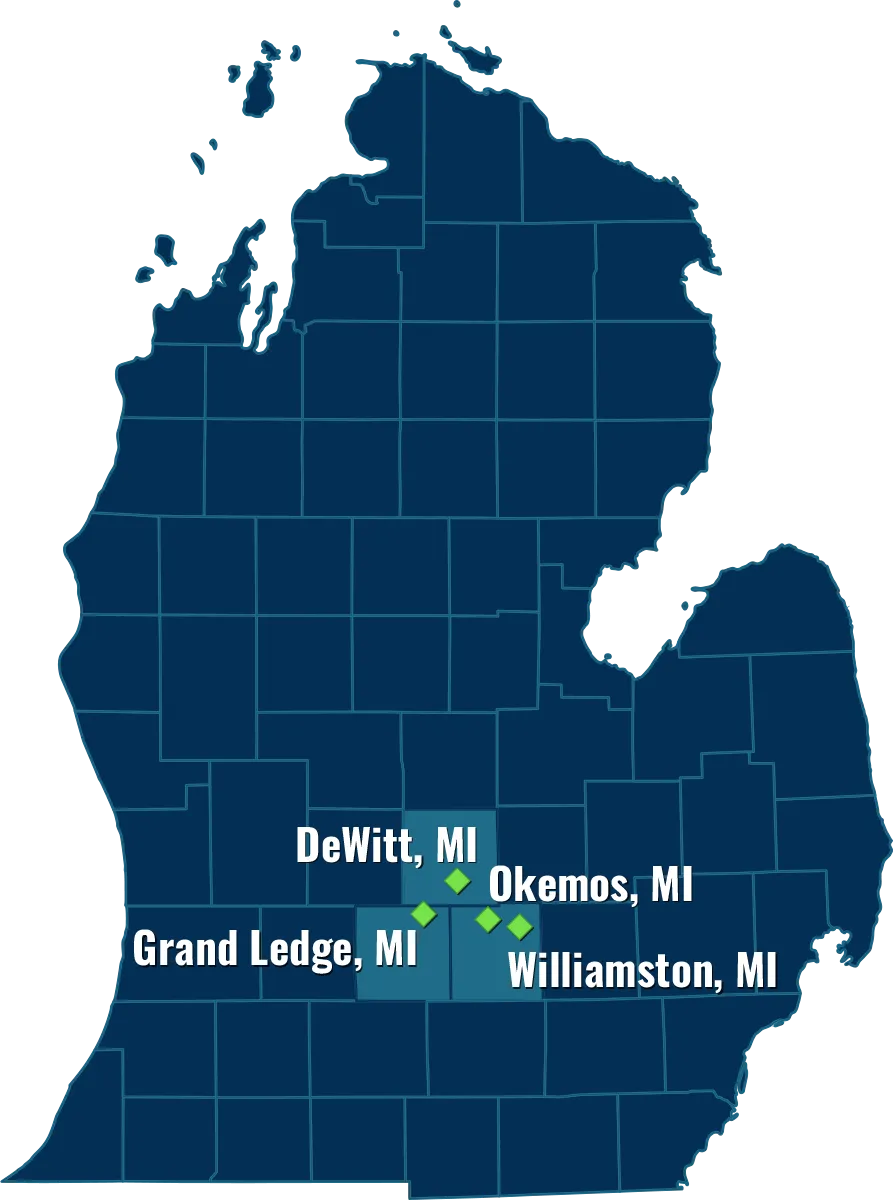

– Okemos, MI Estate Planning

– DeWitt, MI Estate Planning

– Grand Ledge, MI Estate Planning

– Williamston, MI Estate Planning