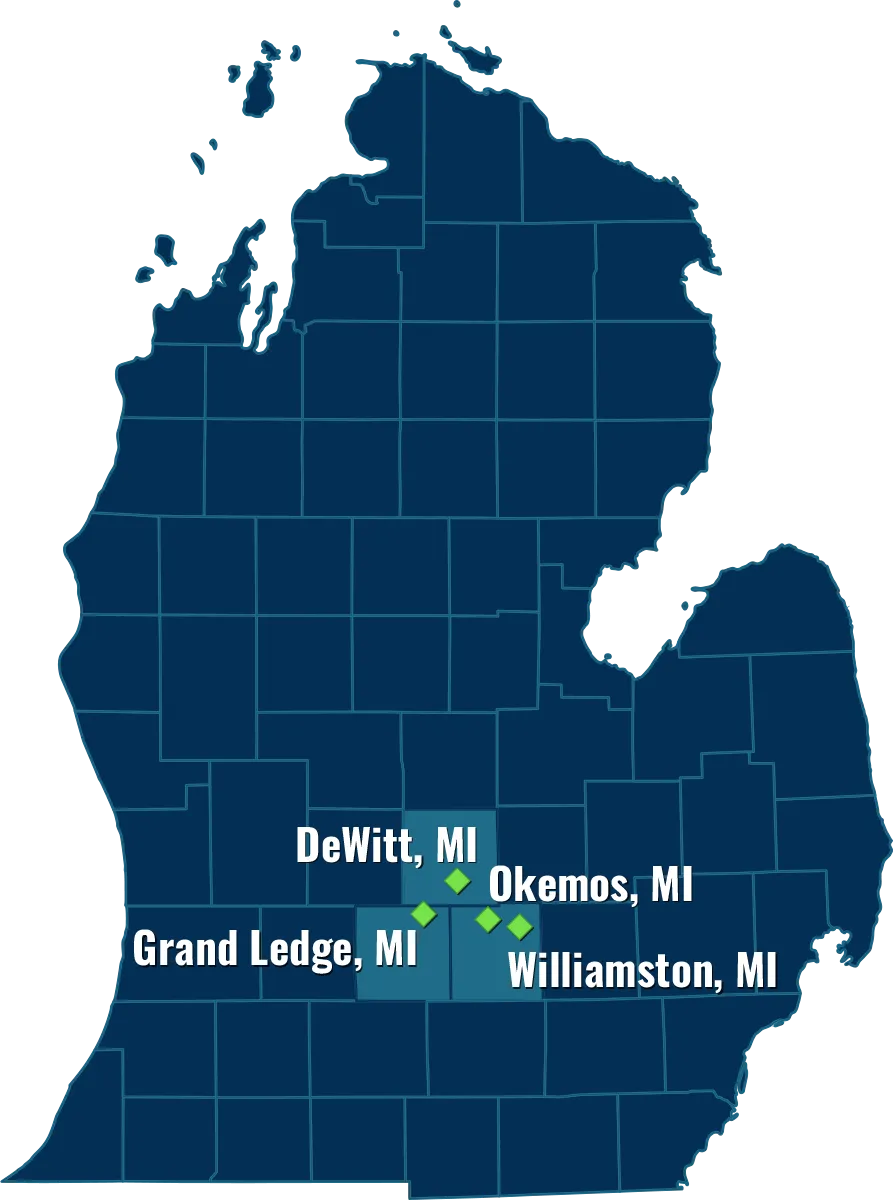

Current client? Reach out to us and get directions:

Current client? Reach out to us and get directions:

There can be terrific grief and pain at the loss of a loved one. Beyond grief and pain, when you add external stresses to the equation you can have a disaster on your hands in very short order.

When a person passes away, their estate must be administered, including locating their assets, paying taxes owed, inventory and appraisal, and much more.

Asset protection planning involves making prudent decisions today to protect yourself, your business, and your hard-earned assets from loss.

Elder law is another aspect of estate planning, focusing primarily on the needs of families and individuals as they age.

Your estate plan offers a number of protections for minor children, which is why it’s so important for families in Michigan to have a comprehensive estate plan.

– Okemos, MI Estate Planning

– DeWitt, MI Estate Planning

– Grand Ledge, MI Estate Planning

– Williamston, MI Estate Planning

My goal as a Lansing estate planning lawyer is to be your trusted advisor who helps you make the very best personal, financial, and legal decisions for you and your family throughout your lifetime. I want to help you not just now, but also when you can’t be there so I can help guide your loved ones as efficiently as possible.

You have made a big step toward peace of mind simply by reading this.

At Leydorf Law Firm, PLLC, we’ve built our reputation on working professionally with growing families in the Lansing area and all over the state to help them create the best estate plans. We understand you’re busy raising a family and building a legacy, so we’ve made the process of estate planning as easy and convenient as possible.

Our process begins with a Family Wealth Planning Session. Before the Session you will complete homework that will have you feeling more organized and put together than you have in a long time. Maybe ever.

Many benefits come with estate planning. The primary reason to have a detailed plan is to protect the beneficiaries of your estate in the event of your death. Without one, it will be up to the courts to decide who gets your assets, a process that can be very costly, time-consuming, and even ugly at times. An estate plan also helps ensure your young children are cared for in a manner that you approve in the event of the unthinkable. If you have small children, you owe it to yourself to create a plan on how they will be taken care of. You should consider setting up a trust to hold your assets and name their guardians to secure their future should both parents die before the children turn 18.

Estate plans also allow individuals to transfer assets to their beneficiaries with the smallest possible estate transfer tax burden. With the help of an estate planning attorney in Lansing, you can considerably reduce federal taxes and state inheritance and estate taxes through your plan. Without an estate plan, the amount your beneficiaries may owe the Internal Revenue Service could be a burden.