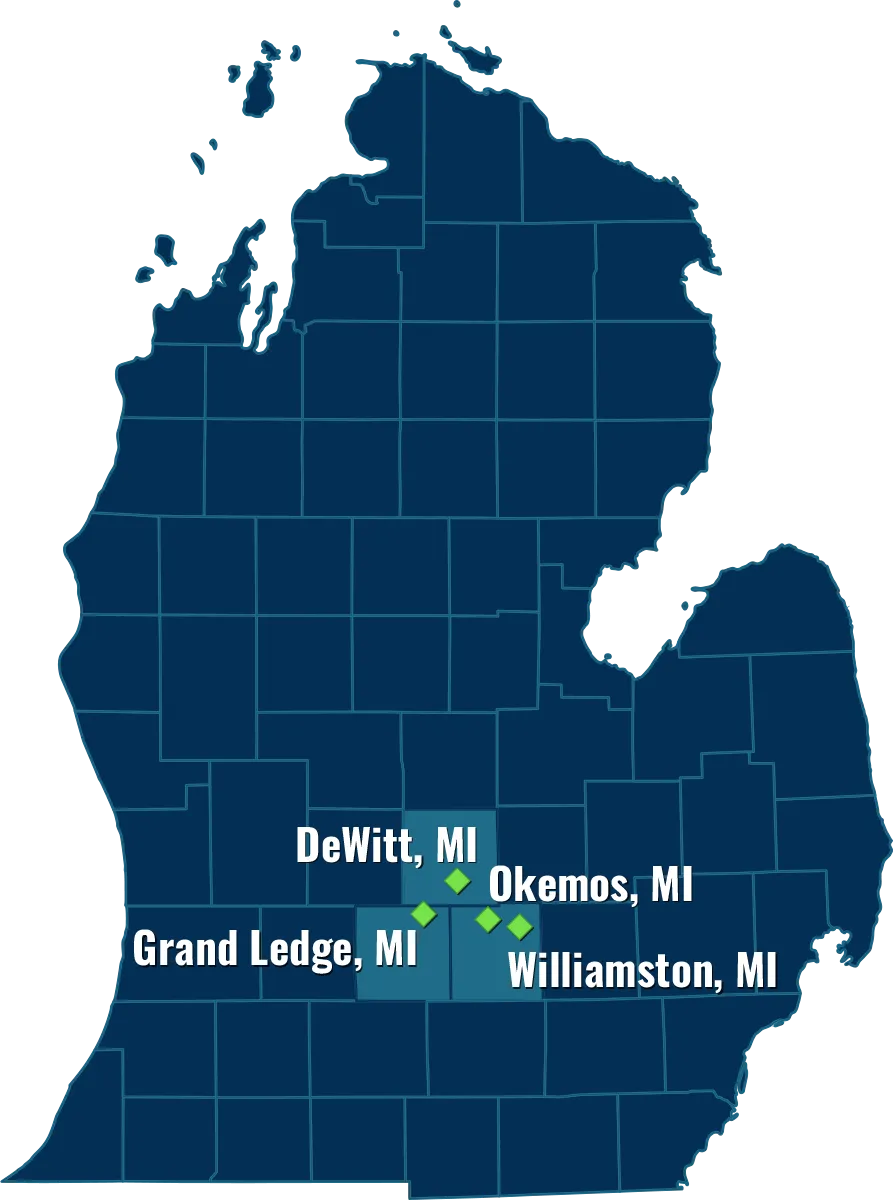

Current client? Reach out to us and get directions:

Current client? Reach out to us and get directions:

When a family member has special needs or is disabled, planning for the present and the future becomes more important and requires knowledge and experience in law specific to this area. Our focus on serving the Special Needs community is supported by a team of attorneys, paralegals, and care coordinators. We understand the challenges and opportunities presented in planning for a Special Needs family member.

People with special needs can have a range of disabilities, including autism, Asperger's syndrome, cerebral palsy, Down syndrome, dyslexia, dyscalculia, dyspraxia, dysgraphia, blindness, deafness, ADHD and cystic fibrosis. They can also include cleft lips and missing limbs.

The cornerstone of Special Needs planning is to protect the individual’s eligibility to receive government benefits. Mistakes occur in one of two ways: a well-intentioned family member may wish to leave assets for the individual in their will, or a family member thinks their only option is to disinherit the person completely. Neither works.

An inheritance could cause a Special Needs individual to lose government benefits, including Supplemental Social Security, Medicaid, or other means-tested programs. If the inheritance is not refused, it can cause your loved one to temporarily lose the ability to stay in a group home, attend social or occupational programs, lose medical appointments and undo all of the planning and scheduling done to create a stable routine. At the same time, government programs are not always enough for an individual to maintain a comfortable standard of living. The family may want their loved one to enjoy a life with more than basic needs being met.

1. Increased security and peace of mind – Special needs planning can help ensure that your loved one will be taken care of, even if something happens to you.

2. Greater independence – Special needs planning can help your loved one become more independent by providing the resources they need to live as independently as possible.

3. Enhanced quality of life – Special needs planning can help improve your loved one’s quality of life by ensuring that their basic needs are met and they have access to the services and supports they need.

4. Improved financial stability – Special needs financial planning can help you and your family manage the challenges that come with having a loved one with special needs.

5. Continuity of care – Special needs planning can help ensure that your loved one will continue to receive the care and support they need, even if you are no longer able to provide it.

There are many options to enhance the quality of life for a Special Needs individual as well as ensuring their support after parents have passed and are no longer living or able to care for them. One of the most commonly used is a Special Needs Trust, which is managed by a trustee for the beneficiary.

One of the tools used to accomplish this is a Special Needs Trust (SNT), a trust designed specifically for an individual with disabilities. Assets in the trust are owned by the trust, so the person remains eligible for government benefits, while parents or trustees make decisions about investments and distributions for the trusts. An SNT can be funded while the parents are alive, or it can be funded by life insurance proceeds.

ABLE accounts were created to provide the ability for disabled individuals to save a certain amount of income and allow family members to contribute to their accounts without losing government benefits. In Michigan, the state’s MiABLE account allows eligible individuals, family, and friends a way to save tax free for qualified disability expenses.

The MiABLE account allows savings to grow tax-free and there are no federal or state taxes owed on withdrawals, as long as they are used for qualified expenses. The maximum amount allowed in the account is $100,000. If that amount is exceeded, the owner could have their Supplemental Security Income benefits suspended or reduced, so this account needs to be carefully managed. There are some restrictions, but we can help you navigate them to make the most of this opportunity.

Special Needs individuals need protection while caregivers are living and after they have passed. We can create a plan to give you the peace of mind knowing your loved one will have a secure and enjoyable life now and in the future. Your estate plan will also alleviate the financial burden for siblings or other relatives who are involved with your loved one’s care. Book a call with us today.

– Okemos, MI Estate Planning

– DeWitt, MI Estate Planning

– Grand Ledge, MI Estate Planning

– Williamston, MI Estate Planning