Current client? Reach out to us and get directions:

Current client? Reach out to us and get directions:

When a person passes away, his or her estate must be administered, including locating his/her assets, paying taxes owed, inventory and appraisal, filing the will, and often providing accounting to beneficiaries. The process of managing a decedent’s estate is known as estate administration. Estate administration can be a complicated process, especially when it involves asset location and complex procedures. Everything from ensuring the necessary taxes are filed, to taking an inventory of the property, and to distributing the remaining assets can be extremely overwhelming. Even worse, this process comes at a time when people are emotionally drained due to the loss of a loved one. With all the complexities associated with trust and estate administration, it’s a good idea to work with experienced legal counsel to minimize conflict and ensure the deceased’s assets get to the right beneficiaries in the smoothest way possible. A trust and estates attorney can provide legal counsel to help you resolve issues to do with trust assets, debts, and disputes.

If the deceased created a trust to hold their assets, the named trustee must ensure the trust’s terms are adhered to. The trustee has many responsibilities, and they must follow the law and the trust agreement when making decisions. At Leydorf Law Firm, PLLC, we are ready to make the process of trust and estate administration as seamless and painless as possible. If the deceased left behind a will and no other documents, probate will be required. Probate is simply a court process where the validity of a will is determined. Probate is a complicated legal process that requires executors of the estate or the next of kin to prepare forms, submit filings in court, meet deadlines, and notify heirs, creditors, and any involved parties. Serving as an executor of an estate entails a massive level of responsibility, especially when you don’t have a legal background and experience. Luckily, a skilled attorney can work with the trustee to ensure proper administration.

Some of the benefits of hiring an attorney include the following:

Additionally, skilled local attorneys can work closely with all the interested parties to ensure the decedent’s assets are collected, the necessary estate taxes are filed, and that every beneficiary gets their rightful share of the estate. If the deceased held their assets in a trust and the named beneficiaries are 18 years or older, the assets may be distributed outright to the beneficiaries. But if the beneficiaries are minors, the assets may be held in a trust to support the needs of the children until they are adults. If the deceased did not create a trust, the court might appoint a person to manage the estate until the heir reaches 18 years. Handling these processes without a legal background or experience can be an insurmountable task, not to mention the costly mistakes you can make, so do not delay in hiring a professional.

With decades of experience in guiding clients through estate and trust administration, no task is too complicated for our legal advocates. Our firm can guide you on how assets should be handled and in the preparation of the necessary tax returns. Our goal is to make the process of transferring assets stress-free, help our clients to avoid costly court proceedings, and ensure our clients have peace of mind. No matter how complicated your situation seems, Leydorf Law Firm, PLLC can guide you from the beginning to the end, making the process as understandable and stress-free as possible. Call today to get started.

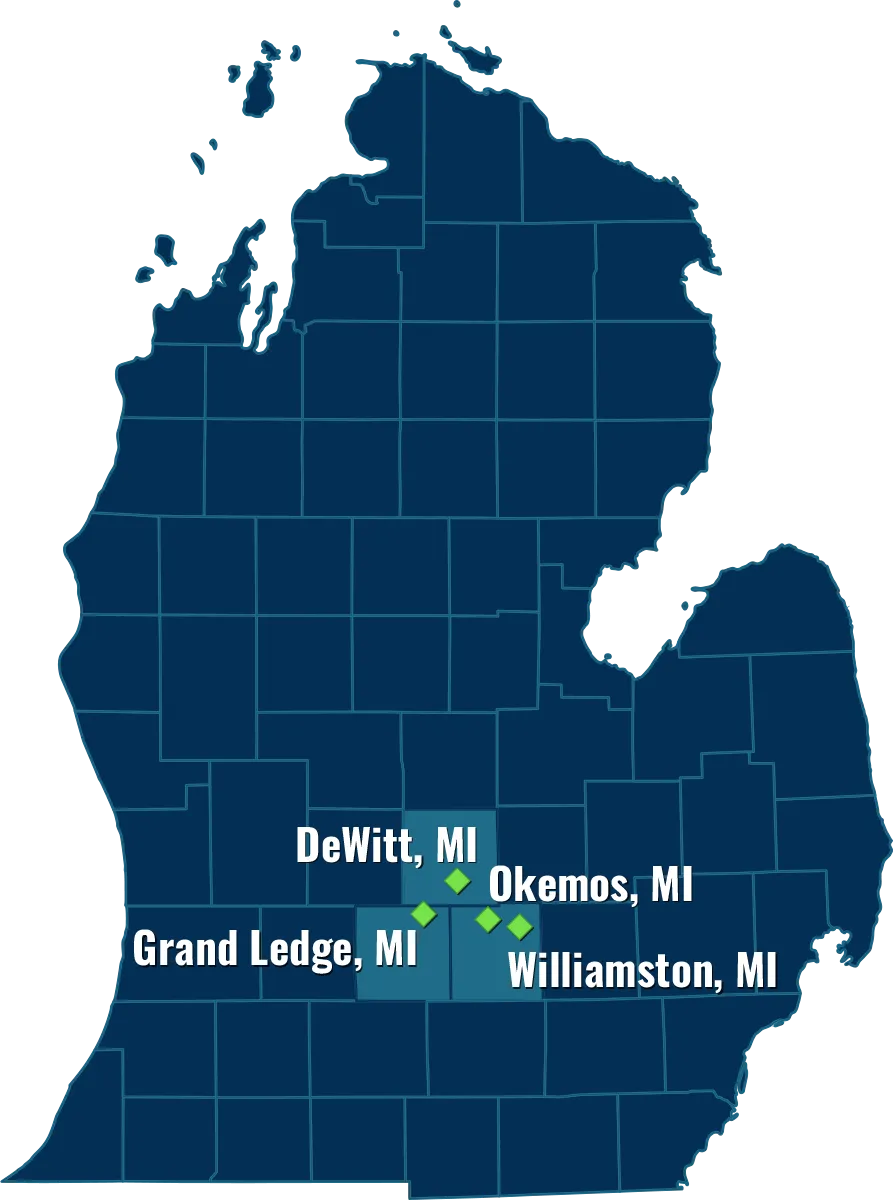

– Okemos, MI Estate Planning

– DeWitt, MI Estate Planning

– Grand Ledge, MI Estate Planning

– Williamston, MI Estate Planning